President Trump signed the “Big Beautiful Bill” yesterday.

I reviewed all the tax specific changes so that you can be informed about how it impacts your wallet.

If you have any questions about the changes, feel free to comment..

Let’s get into it.

Extension of the rates

The tax bill makes the tax rates enacted in 2017 permanent.

As a reminder, if this tax bill didn’t pass, they would have increased to:

12% -> 15%

22% -> 25%

24% -> 28%

32% -> 33%

37% -> 39.6%

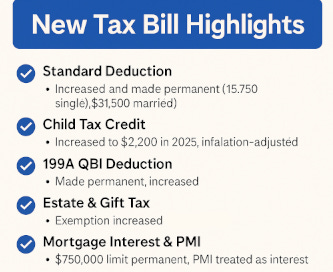

Extension and enhancement of increased standard deduction

The bill makes the TCJA standard deduction permanent.

It also increases the base standard deduction to $15,750 (single), $23,625 (head of household) and $31,500 (married jointly) for 2025, and will be inflation adjusted after that.

Deduction for seniors

Before Jan 1, 2029, there will be allowed a deduction of $6,000 for each individual who is age 65 before the close of the year, effective 2025.

However, the $6,000 will be reduced by 6% of the amount by which your adjusted gross income exceeds $75,000 ($150,000 if you are filing jointly).

For example, say you have an $85,000 income, but the threshold is $75,000 ($10,000 excess).

$10,000 * 0.06 = $600. New deduction is $5,400.

Child tax credit

The child tax credit amount is increasing from $2,000 to $2,200, effective 2025.

Starting in 2026, the $2,200 amount will be increased by a cost-of-living adjustment.

The bill also makes this amount permanent.

It also increases the maximum amount of the refundable credit ($1,400) with inflation.

Deduction for Qualified Business Income

The bill makes the 199A (QBI) deduction permanent.

It also increases the phaseout ranges for SSTBs from $50,000 to $75,000 (single) and from $100,000 to $150,000 (married).

It also creates a minimum $400 deduction as long as you have at least $1,000 of qualified business income, starting in 2026.

Increased Estate and Gift Tax Exemption

The estate and gift tax exemption is increasing from $13.99M to $15M, effective in 2026.

It will also increase with inflation after that.

Interest deduction for qualified residence

Makes the $750,000 mortgage interest deduction limit permanent.

It also adds mortgage insurance premiums to be treated as interest, so PMI will be treated like interest for the purpose of this deduction, effective 2026.

Limitation on tax benefit of itemized deductions

This law brings back a modified version of “Pease Limitation” effective 2026.

The total itemized deduction will be reduced by ~0.5% times the lesser of:

Itemized deductions

Taxable income that exceeds the amount of 37% bracket

Effectively, if your taxable income is less than ~$626,350 you wouldn’t be impacted by the limitation.

Extension and modification of wagering losses

The bill limits how much you can deduct for gambling losses to 90% of your total losses, AND you can only deduct losses up to the amount of your gambling winnings for the year effective 2026.

State and local taxes

The state and local tax deduction is increasing to $40,000 in 2025.

It will increase to $40,400 in 2026 and continue to increase by 1% annually until 2030.

In 2030, it will revert to $10,000.

There is also a $500,000 threshold (for both single and married filers), and the deduction will be reduced by 30% of the amount by which it exceeds that threshold, but not below $10,000.

No Tax On tips

A new $25,000 deduction is created for qualified tips, effective from 2025 through 2028.

The deduction is reduced by $100 for each $1,000 by which your gross income exceeds $150,000 (single) or $300,000 (married).

It’s allowed even if you take the standard deduction.

“Qualified tips” means tips received in an occupation where tips are customarily and regularly received.

The Treasury will also publish a list of qualifying occupations and provide guidance to clarify any additional information to prevent abuse.

Example:

You make $50,000, of which $30,000 is from tips, and are single.

You will receive a $25,000 deduction for the tip income saving ~$3,000 on your federal taxes.

No tax on overtime

A new $12,500 deduction (single) or $25,000 (married jointly) is created for overtime, effective from 2025 through 2028. It is allowed even if you take the standard deduction.

The deduction is reduced by $100 for each $1,000 by which your gross income exceeds $150,000 (single) or $300,000 (married).

Overtime will be included on the W-2, or “reasonably estimated” for the first year of the law.

Example:

You make $100,000, of which $10,000 is from overtime, and are single.

You will receive a $10,000 deduction for this overtime, saving ~22%, or about $2,200 on your federal taxes.

By the way, if you want to support me & learn more about saving money on taxes and build wealth, consider becoming a paid subscriber:

No tax on car loan interest

There will be a $10,000 deduction on car loan interest, effective from 2025 through 2028.

The deduction will be reduced by $200 for each $1,000 by which your gross income exceeds $100,000 (or $200,000 if married).

The final assembly of the car must be within the US to qualify.

Trump account

A Trump account is established as an individual retirement account (IRA), which is not a Roth, for a beneficiary under 18 years old.

The maximum contribution per year is $5,000. No deduction is allowed. No withdrawals before age 18. The account can only be invested in funds with an expense ratio of 0.1% or lower.

There will be a pilot program that provides a $1,000 tax credit for a child born between Jan 1, 2025, and 2028.

Bonus depreciation & Sec 179 expensing

Bonus depreciation is made permanent and is now 100% as long as the property is placed in service on or after January 19, 2025.

The bill also increases the maximum amount a taxpayer may expense under Sec. 179 to $2.5 million, reduced by the amount by which the cost of qualifying property exceeds $4 million.

Dependent care

Increases the Dependent Care FSA limit from $5,000 to $7,500.

Raises the maximum percentage of qualified expenses you can claim for child and dependent care from 35% to 50%, effective in the 2026 tax year.

529 expansion

The bill allows 529 savings plans to be used for expenses (tuition or books) related to attendance at elementary or secondary school, starting in 2026.

Also, postsecondary credentials are treated as higher education expenses for 529 plans.

Excise tax on investment income of private colleges and universities

Higher education institutions will pay a tax of:

1.4% if a student-adjusted endowment (value of all their assets divided by number of students) is at least $500k but less than $750k

4% if a student-adjusted endowment is at least $750k but less than $2M

8% if a student-adjusted endowment is at least $2M

Opportunity zones enhancement

The tax bill makes opportunity zone investments (economically distressed areas) permanent, effective 2027.

As a reminder, opportunity zones allow you to:

Defer capital gains tax

Receive a step-up in basis for a set percentage

Or even fully eliminate capital gains

20. Permanent and expanded deduction for charitable contributions

Charitable contributions of $1,000 (or $2,000 if married) will now be deductible even if you don’t itemize your deductions.

In other words, if you take the standard deduction, you can still deduct your charitable contributions starting in 2026.

21. Qualified Small Business Stock (QSBS)

Currently, you must hold QSBS for 5 years to exclude up to 100% of capital gains, subject to certain limitations.

The new bill establishes a minimum 3-year holding period with a phased schedule, along with an increase in the asset qualification threshold:

22. 1099-K

You may remember that under the American Rescue Plan, the 1099-K thresholds started changing to a $600 threshold goal.

The new law repeals that threshold and rolls back to a $20,000 limit and 200 transactions for Venmo, CashApp, PayPal, etc starting in 2025.

23. Termination of EV subsidies

> Used car credit – terminates after September 30, 2025

> New car credit – terminates after September 30, 2025

> Sec. 25C energy-efficient home improvement (windows, water systems, etc) – terminates after December 31, 2025

> Sec. 25D residential clean energy credit (e.g solar panels) – terminates after December 31, 2025

Overall, there are a lot of changes. I hope this clarifies some confusion.

Chat next Saturday.