How to Pay No Taxes in Retirement 🏝

How to cut your tax bill to $0 and avoid future taxes in retirement

John and Arielle are married, both age 50. They have a son who is 18 and about to enter college. They decided to retire.

Both of them did fairly well in their early years. John was an engineer for 29 years, working for a big publicly traded firm, and eventually rose to a principal rank. Arielle was a personal finance teacher.

Through employee stock purchases (that they’ve reinvested in ETFs), pre-tax 401(k)/457(b), and Roth IRA, they were able to save $3.5M, split between $2M in a brokerage account (25% of the amount is basis, with some recent lots having as much as 80% in basis), $1.3M in a pre-tax 401(k)/403(b), and $200K in a Roth IRA.

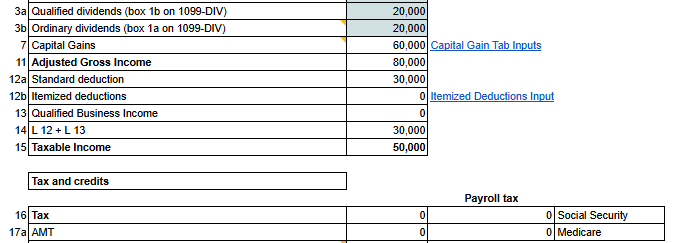

They receive $20,000 from qualified dividends from tax-efficient index funds.

They moved to a state like Texas where there are no state income taxes (the concept will apply regardless of the state though).

They decide to use a 4% rule to withdraw from the brokerage account (which will put them at around 2.2% of their overall portfolio).

Dividends: $20,000

Long term capital gains: $60,000 ($80,000 – $20,000 basis)

So, they receive $100,000 of cash per year.

Their tax impact? $0 of taxes owed to the IRS:

This is because the capital gains and qualified dividends are taxed at preferential rates, and could be taxed at 0% depending on taxable income.

Additional planning opportunity:

We know that once they turn 62, they could be receiving Social Security benefits.

They will also be required to take RMDs following the year they turn 73.

They might also have some pension income, typically around age 65.

All these things are taxable and could push them into a higher tax bracket. This is why we want to start minimizing that impact.

Roth Conversions

They still have about ~15 years to do Roth conversions.

Since they have about $1.3M in a traditional IRA, we can start moving substantial amounts into a Roth IRA.

Let’s say we convert $50,000 of traditional IRA → Roth IRA per year.

What will be our total tax impact? $1,768 of net tax for $100,000 of cash + $55,000 taxable conversion:

One of the reasons it’s so low is because they also received a $2,000 tax credit for paying $2,000 of qualified education expenses (AOTC credit) for their son entering college.

If there is a market downturn, they could move a significant amount of shares into a Roth while paying minimal tax.

Over the next 4 years, they can continue converting $55,000 per year from a 401(k) to a Roth.

Once their son is out of college, they will lose the $2,000 tax credit but can still convert ~$40,000 with minimal tax impact.

In these 10-15 years, they can convert $500,000 into a Roth IRA while paying ~$35,000 of total tax.

They were contributing back when they were working and at 24–32% marginal tax rates, saving ~$140,000 of tax, for a net of $105,000.

The conversions will substantially decrease (almost in half) the amount of RMDs they need to take each year at 73.

Additional ways to minimize tax

1. They could contribute to an HSA while retiring at 50 and using ACA insurance.

2. Itemized deduction bunching:

Some counties allow you to make a payment in December for the future year, while also making a payment in January of that same year for the full year.

i.e. in January 2024, you pay 2023 taxes, while in December 2024, you pay 2024 taxes. Property taxes are deducted in the year they were paid.

While this likely might not make an impact now (the SALT cap is $10,000), a future law might increase the SALT cap to $40,000, potentially making a bigger impact.

3. Charitable contributions as part of the itemized deductions.

Retirement Age

At 65, they can start taking pensions and Social Security benefits (SSBs).

They now choose not to withdraw any amounts from their brokerage account, only keeping the qualified dividends.

They plan to pass the brokerage account to their son when they pass away. The son will get a step-up in basis and eliminate all capital gains tax.

With $50,000 of taxable pension, $50,000 of traditional IRA withdrawals, and $20,000 of dividends, totaling $120,000 of cash withdrawn, the federal tax impact is only $6,639, or a 5.5% effective tax rate.

This income is also below the IRMAA threshold for the Medicare surcharge.

Due to Roth conversions, the Roth IRA grew to $1M. They can also pass it down to their son, who can withdraw it all tax-free.

This is why tax planning is important. You really have to think long term.

If you want to get my other best posts and access to a community, consider becoming a paid subscriber:

See you next Saturday.

MC, CPA

Please correct me if I’m mistaken. Wouldn’t this couple (aged 50) be required to start taking RMD’s beginning when they turn 75?