Step Up Basis 📈

How one mistake cost $430,000 of taxes and how you can avoid it with step-up basis...

Bob made a very expensive tax mistake.

Doctors told Bob that he only has a year to live…

What did Bob do?

He decided to gift a house to his only son before passing away.

The house is worth $2,000,000 that he acquired back in 1970 for $50,000 in an expensive suburb of California.

The son decided to sell the house and paid ~$430,000 of federal taxes.

$430,000 that could have been $0 instead…

How?

When you gift a property to someone, they receive a “carryover basis.” It basically means the same price the original owner purchased it for.

So, the basis of that house was $50,000, and the son had to pay capital gains tax of 23.8% on the difference between the sale price ($2M) and the basis.

BUT, this is where a step-up basis could’ve come into play.

Assets (house, shares held in a brokerage account, etc.) that you own inside an estate (essentially not in an irrevocable trust) receive a step-up basis to their fair market value (FMV) at the time of the decedent’s death per the IRC Section 1014.

In our case, if Bob held that house in his own name, passed away, and his son received the house, he would’ve gotten a step-up in basis to the current value, or $2M.

At the time of the sale, if sold for $2M, he would pay $0 in federal taxes (state tax might apply).

That’s ~$430,000 of savings.

“But who cares, Bob is dead anyways?”

While that’s true, many parents still want to ensure that their children don’t have to pay half a million in taxes if they don’t have to.

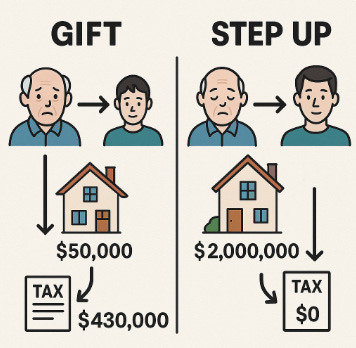

Quick visual summary:

Specifics

The step-up in basis can be a bit nuanced, depending on how the assets are held and titled.

First, the step-up in basis typically adjusts to the market value, unless an election is made to use a value 6 months after the date of death (some rules apply).

The step-up in basis also doesn’t apply to assets held in an irrevocable trust (but we will discuss some strategies there) or to assets held in qualified retirement accounts (IRA, 401(k), etc)

In a community property state (AZ, CA, ID, LA, NV, NM, TX, WA, WI), the basis steps up whenever a spouse dies. You will typically need to complete a form to receive this step-up in a brokerage account. For example, Fidelity has a “Cost Basis Update – Date of Death Step-Up” form.

For assets held in joint tenancy, the step-up applies only to the deceased partner’s share. For example, Bob and Jenice have a house worth $300,000 with a $50,000 basis. After Bob passes away, Jenice will have a $175,000 basis in the house (($300,000 – $50,000) / 2 + $50,000).

Additional tax planning opportunities

Living on the right assets

Bob, age 75, has 2 accounts: a traditional 401(k) worth $500,000 and a brokerage account worth $500,000. Bob’s diagnosis isn’t good.

From a tax planning perspective, it might make a lot more sense to withdraw, say, $50,000 per year to live off (of which $20,000 is RMDs) from the 401(k) and pass down the brokerage account to his beneficiaries.

This is because the brokerage account likely has a lot of gains (Bob bought many stocks in his 30s–40s) that could be stepped up. But a more in-depth analysis might be needed if Bob has a lot of income and is in a high marginal tax bracket.

P.S. Do you want to support my writing and get exclusive perks? Consider becoming a paid subscriber:

Selling the right lots

Say Bob has a $500,000 brokerage account. Some of the stock purchases have a low basis (meaning a lot of capital gains), and some of the stock purchases have a high basis (low capital gains).

It’s best to sell stocks with a high basis (low capital gains tax) and pass down the low basis stocks to the beneficiaries.

Taking loans

Depending on the portfolio size, it could make sense to take out a loan instead of paying capital gains.

Irrevocable trust planning

Assets inside an irrevocable trust don’t get a step-up in basis, as they are considered outside of an estate. But there is a potential planning opportunity by using the swap power.

Typically, irrevocable trusts hold assets with a low basis. These trusts often include the “swap power,” or the ability to exchange assets in an irrevocable trust with other assets of equivalent value.

Say a wealthy individual has $1M of cash and $1M of stocks held in an irrevocable trust (with $50,000 of basis). He could swap that cash, get the stocks out of the irrevocable trust, and the beneficiary could receive a step-up in basis.

Of course, not everyone would have sufficient assets to exchange, but it could be a good way to save money on taxes in the right circumstances.

Donations

There are some families that are charitably inclined. Say Bob has $1M in an IRA and $1M in a taxable brokerage account. His kids are doing great financially.

Bob wants to give away $1M to a charity. In his situation, giving away $1M from the IRA is better tax-wise than giving $1M from the brokerage account, since the step-up basis will apply to the beneficiaries, resulting in less taxes when they sell.

Planning matters. These mistakes can cost thousands of dollars in unnecessary taxes.

See you next Saturday.